Regelbasierte Datenqualität - Anpassbar, Transparent und Nachverfolgbar

digna Data Validation erlaubt Ihnen, benutzerdefinierte Validierungsregeln auf Datensatzebene zu erstellen und automatisch anzuwenden — abgestimmt auf Ihre geschäftlichen oder regulatorischen Anforderungen.

Wie digna Data Validation funktioniert

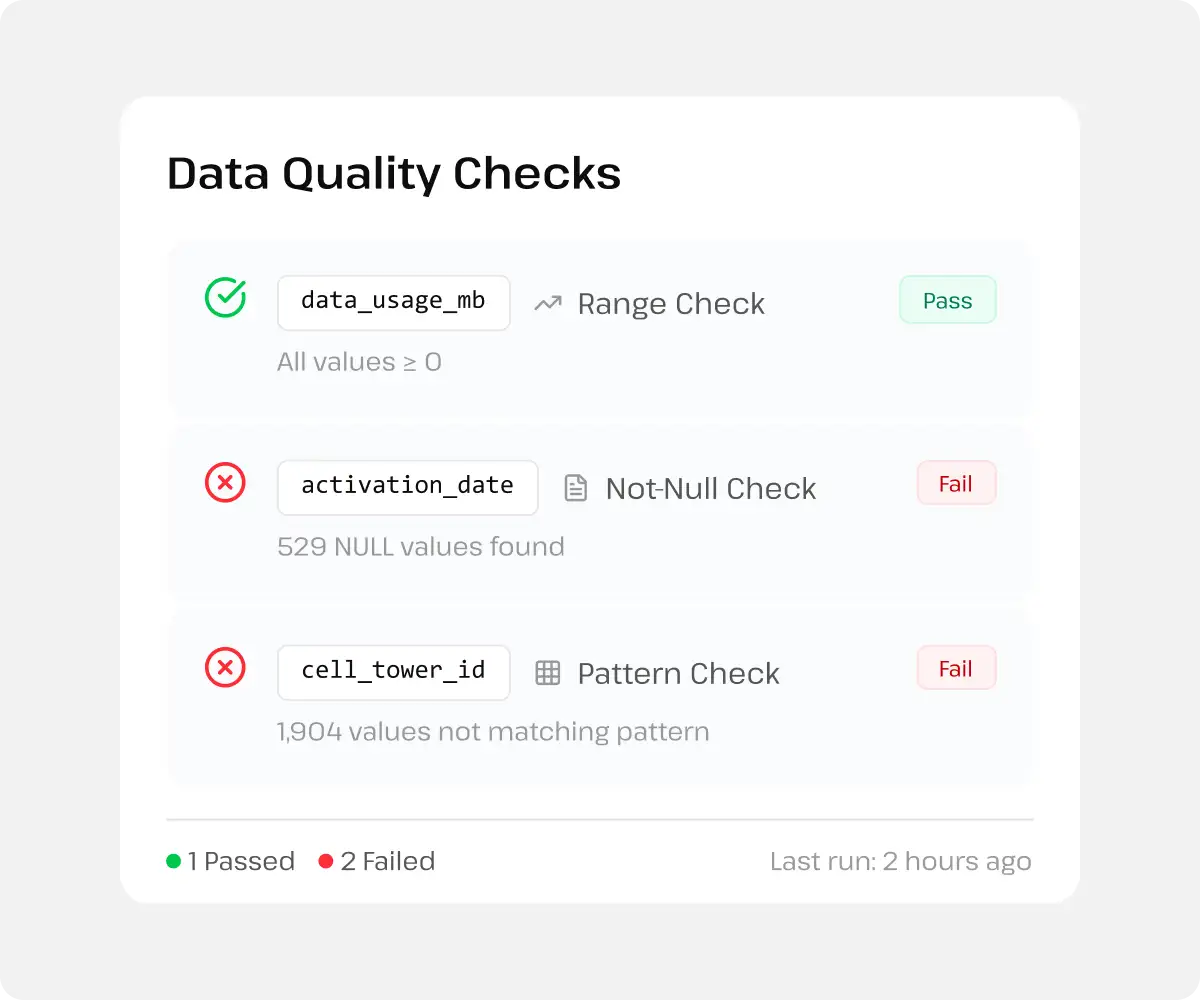

Das Modul unterstützt Überprüfungen auf exakte Werte, Schwellenwerte, Bereiche und Referenzlisten, um Qualität sowie die Einhaltung von geschäftlichen und regulatorischen Vorgaben sicherzustellen.

Überprüfen Sie jede einzelne Datenzeile mithilfe anpassbarer Regeln. Überprüfen Sie spezifische Werte, Bereiche, Schwellenwerte, das Vorhandensein von Null oder eine Referenzliste in jeder Tabelle.

Regeln können von technischen oder geschäftlichen Nutzern über eine intuitive Benutzeroberfläche erstellt werden. Von "Rechnungsbetrag muss positiv sein" bis hin zu "Währungs-Code muss in {EUR, USD} sein", definieren Sie, was "gültig" bedeutet.

Jede Regel führt Protokollergebnisse aus, einschließlich der Anzahl der fehlgeschlagenen Datensätze und der genauen Fehler. Alle Validierungsergebnisse sind einsehbar, exportierbar und leicht nachverfolgbar.

Anwendungsfall: Validierung von Rechnungsaufzeichnungen

Stellen Sie sicher, dass Rechnungen den Steuergesetzen und internen Richtlinien entsprechen:

Regelname | Spalte | Bedingung | Status | Fehlgeschlagene Datensätze |

|---|---|---|---|---|

Betrag muss positiv sein | invoice_amount | invoice_amount > 0 | ✅ Bestanden | 0 |

USt-IdNr erforderlich | vat_code | vat_code IST NICHT NULL | ❌ Fehlgeschlagen | 23 |

Maximaler Rechnungsbetrag | invoice_amount | invoice_amount <= 100.000 | ✅ Bestanden | 0 |

Währungs-Code-Gültigkeit | currency_code | currency_code IN ('EUR', 'USD') | ❌ Fehlgeschlagen | 8 |

Rechnungsdatum darf nicht in der Zukunft sein | Zukunft | invoice_date <= HEUTE | ✅ Bestanden | 0 |

Ergebnis: digna markiert 31 nicht konforme Datensätze (fehlende Mehrwertsteuercodes, ungültige Währungen) durch Anwendung von 5 Geschäftsregeln auf die Rechnungstabelle und löst Warnungen für sofortige Maßnahmen aus.